View All Categories +

1

/

of

8

Finance Printable Pack

Finance Printable Pack

Regular price

$29.00

Regular price

Sale price

$29.00

Unit price

/

per

Couldn't load pickup availability

Overview

Finances can be stressful! This kit will help you organize all those important financial documents in one place and develop a plan to stay on track.

WHAT'S INCLUDED

- Auto Paid Bill Info- Record important information related to bills that are automatically drafted from your account such as payment frequency, amount due, date service started, due date, and login information.

- All Bills Tracker- Similar to the Auto Paid Bill Info sheet, except here you record bills that you either write a check for or you need to log in to make your payment.

- Subscription Tracker- While these are considered auto-drafted bills, they are usually different in that they are a fixed amount each time they are drafted. Record this information like you did in the previous two sheets.

- Monthly Bill Tracker- One of the most important parts of the kit! This At-A-Glance sheet will have all of your bills listed in order of their due date. Checking them off each month as they are paid ensures you won’t miss a payment.

- Bill Due Date Tracker- Using the Auto Paid Bills, All Bills, and Subscription trackers, list all bills on the corresponding due dates of this sheet with their amounts, marking if they are auto-drafted.

- Debt Tracker- This will be your master list of all your debts with spots for interest rates, minimum payments, balances, and notes.

- Debt Payment Tracker- Each month, using the Debt Tracker, record the amount paid toward each of your debts along with your new remaining balance. There is also a spot to calculate the total amount paid and new total balance of all your debts.

- Debt Paydown- This is a fun sheet to help you stay motivated as you pay off your debts. As you make payments, color or “fill up” the mason jar, watching it fill more and more each month!

- Savings Jar- Similar to the Debt Paydown sheet, the Savings Jar sheet motivates you as you work toward your savings goal. It also includes a mason jar you will fill in each month representing the amount you’ve saved.

- Monthly Savings- This is a place to track the money you have saved during each month. Simply list the amounts saved, where the money came from, and total it up at the end of the month.

- Monthly Budget-Know where your money is going! This budget sheet is simple, allowing you to enter your own items. Write down each item to be paid, the amount budgeted, the actual amount, and the difference. If you don’t have a lot of categories or like to keep your categories broad, this sheet is for you!

- Annual Finance Summary- This sheet provides a quick overview of how you are doing throughout the year. At the end of each month, write in how much income you brought in, your total monthly expenses, and the difference between the two.

- Monthly Budget Template- This is the same as the Monthly Budget, but it’s more in-depth with pre-filled suggested categories.

- Tax Document Tracker- If you have a more complicated tax return, this tracker will save you so much time! List all the documents needed for tax preparation, then check off the boxes to make sure you’re ready to file. (N=need; H=have; S=scanned/submitted)

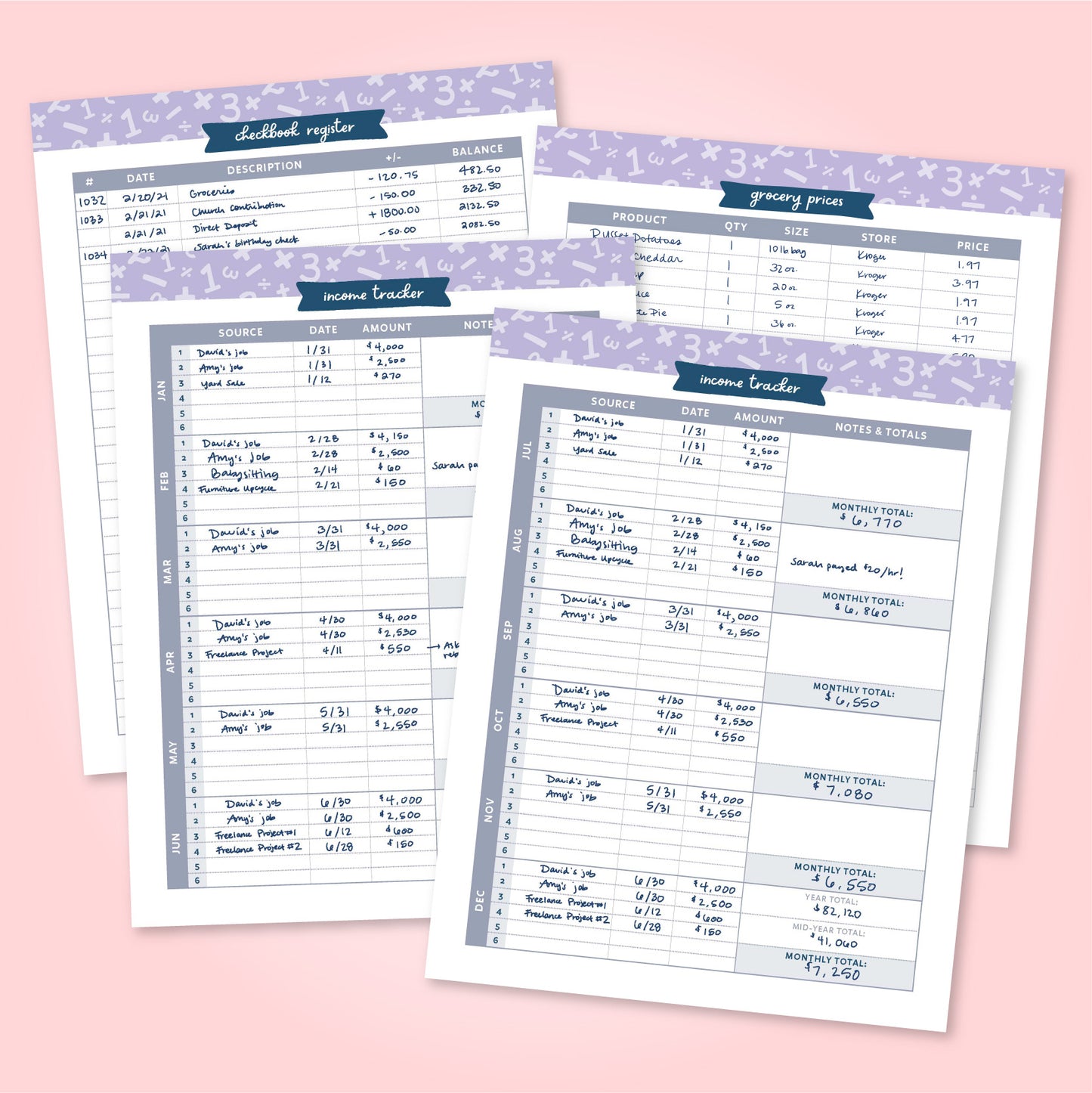

- Checkbook Register- A place to keep all your transactions conveniently in your finance binder. Write in your check number (if applicable), transaction date, the description, how much was withdrawn or deposited, and your new account balance.

- Income Tracker- A helpful tracker when you have multiple sources of income. Each month you can record each source of income with its amount, date, and any notes you may have. There’s also a spot to calculate the total income for the month.

- Grocery Prices Tracker- This tracker has a spot to record your most purchased products so you always know where to get the best deal! Fill this sheet in after a trip to the store and carry it with you the next time you shop to compare pricing.

NOTE: THIS IS A PRINTABLE PRODUCT. NO PHYSICAL PRODUCT WILL BE SHIPPED.